Empower the next generation of Murray learners and leaders through your generous gift of hope, opportunity, and possibility.

Murray Education Foundation works with donors on planned giving schedules, through wills and trusts. But we also understand there are important tax savings opportunities some can take advantage of now.

Here are some powerful ways to make smart investments that leave a Murray legacy for you or your family.

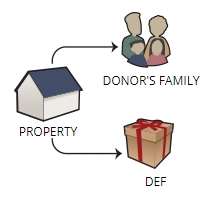

Bequest

You designate our organization as the beneficiary of your asset by will, trust or beneficiary designation form.

Benefits of a bequest

- Receive an estate tax charitable deduction

- Reduce the burden of taxes on your family

- Leave a lasting legacy to charity

How a bequest works

How a bequest works

A bequest is one of the easiest gifts to make. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends or Murray Education Foundation as part of your estate plan, or you can make a bequest using a beneficiary designation form.

Here are ways to leave a bequest to Murray Education Foundation

- Include a bequest to Murray Education Foundation in your will or revocable trust

- Designate Murray Education Foundation as a full, partial or contingent beneficiary of your retirement account (IRA, 401(k), 403(b) or pension)

- Name Murray Education Foundation as a beneficiary of your life insurance policy

A bequest may be made in several ways

- Percentage bequest - make a gift of a percentage of your estate

- Specific bequest - make a gift of a specific dollar amount or a specific asset

- Residual bequest - make a gift from the balance or residue of your estate

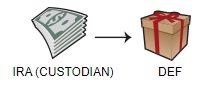

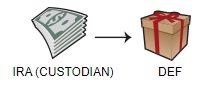

IRA Rollover

Congress has enacted a permanent IRA charitable rollover. As a result, you can make an IRA rollover gift this year and in future years.

Benefits of an IRA charitable rollover

- Avoid taxes on transfers of up to $105,000 from your IRA to our organization

- May satisfy your required minimum distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a gift that is not subject to the deduction limits on charitable gifts

- Help further the work and mission of our organization

How an IRA charitable rollover gift works

How an IRA charitable rollover gift works

- Contact your IRA plan administrator to make a gift from your IRA to us

- Your IRA funds will be directly transferred to our organization to help continue our important work

- Please note that IRA charitable rollover gifts do not qualify for a charitable deduction

- Please contact us if you wish for your gift to be used for a specific purpose

Gifts from your IRA

If you are 70½ or older, you can use your IRA to fulfill your charitable goals. You can use the "Make a Gift From My IRA" tool to contact your IRA custodian and make a qualified charitable distribution. We will acknowledge your generous gifts as a qualified charitable distribution, which may satisfy your RMD, if applicable.

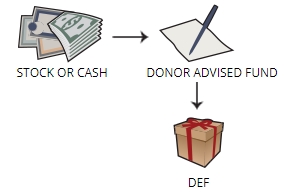

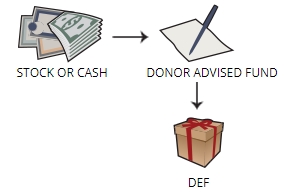

Donor Advised Funds

You fund an DAF and make charitable gift recommendations during your lifetime. When you pass away, your children can carry on your legacy of giving.

You enjoy several benefits with your donor advised fund

- Establish a flexible vehicle for annual charitable giving

- Benefit from a more tax and cost efficient alternative to a private foundation

- Obtain a charitable income tax deduction in the year of your gift

How a donor advised fund works

How a donor advised fund works

- You make an initial, irrevocable gift of cash or stock to fund a DAF at a sponsoring organization

- The assets in your DAF grow tax-free

- You make annual recommendations on gifts to be made from your DAF

Gifts from your donor advised fund

Your donor advised fund has several advantages. You can make one larger gift to a DAF and then recommend grants to us and other nonprofits. You can use the "Make a Gift From My DAF" tool to contact your DAF provider and make a grant. We will acknowledge your generous gift as a DAF distribution.

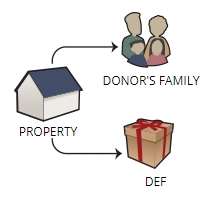

Beneficiary Designation Gifts

You can designate us as a beneficiary in your life insurance policy or any retirement, investment, or bank account.

Benefits of gifts of retirement assets

- Simplify your planning

- Support the causes that you care about

- Continue to use your account as long as you need to

- Heirs can instead receive tax-advantaged assets from the estate

- Receive potential estate tax savings from an estate tax deduction

How to make a gift of retirement assets

How to make a gift of retirement assets

To leave your retirement assets to Murray Education Foundation, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate Murray Education Foundation as beneficiary, we will benefit from the full value of your gift because your retirement assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

Future gifts from your retirement assets

Did you know that 40%-60% of your retirement assets may be taxed if you leave them to your heirs at your death? Another option is to leave your heirs assets that receive a step up in basis, such as real estate and stock, and give the retirement assets to Murray Education Foundation. As a charity, we are not taxed upon receiving an IRA or other retirement plan assets. You can use the "Make a Future Gift of Retirement Assets" tool to contact your retirement plan custodian and designate a future gift to Murray Education Foundation.

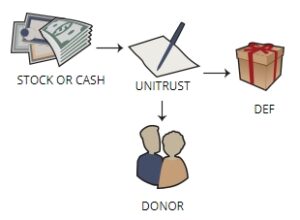

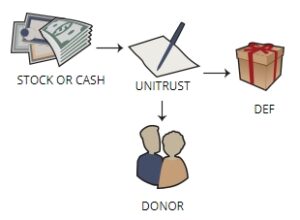

Charitable Remainder Unitrust

You transfer your cash or appreciated property to fund a charitable remainder unitrust. The trust sells your property tax-free and provides you with income for life or a term of years.

Benefits of a charitable remainder unitrust

- Receive income for life, for a term of up to 20 years or life plus a term of up to 20 years

- Avoid capital gains on the sale of your appreciated assets

- Receive an immediate charitable income tax deduction for the charitable portion of the trust

- Establish a future legacy gift to our organization

How a charitable remainder unitrust works

How a charitable remainder unitrust works

- You transfer cash or assets to fund a charitable remainder unitrust.

- In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

- The trust is invested to pay income to you or any other trust beneficiaries you select based on a life, lives, a term of up to 20 years or a life plus a term of up to 20 years.

- You receive an income tax deduction in the year you transfer assets to the trust.

- Our organization benefits from what remains in the trust after all the trust payments have been made.

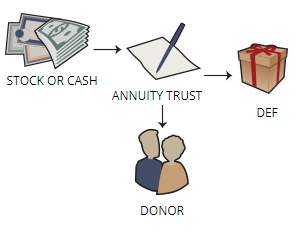

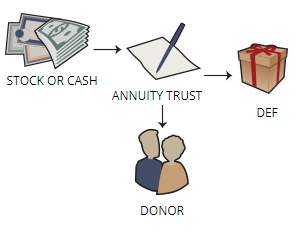

Charitable Remainder Annuity Trust

You transfer your cash or appreciated property to fund a charitable remainder annuity trust. The trust sells your property tax-free and provides you with fixed income for life or a term of years.

Benefits of a charitable remainder annuity trust

- Receive fixed income for life or a term of up to 20 years

- Avoid capital gains tax on the sale of your appreciated assets

- Receive an immediate charitable income tax deduction for the charitable remainder portion of your gift to Murray Education Foundation

How a charitable remainder annuity trust works

How a charitable remainder annuity trust works

- You transfer cash or assets to fund a charitable remainder unitrust.

- In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

- The trust is invested to pay fixed income to you or any other trust beneficiaries you select based on a life, lives or a term of up to 20 years.

- You receive an income tax deduction in the year you transfer assets to the trust.

- Our organization benefits from what remains in the trust after all the trust payments have been made.

More on charitable remainder annuity trusts

If you are tired of the fluctuating stock market and want to receive fixed payments, a charitable remainder annuity trust may provide you with the stability you desire. A charitable remainder annuity trust pays a fixed amount each year based on the value of the property at the time the trust is funded.

Gift and Bequest

A gift and bequest is a combination of a current gift and a charitable gift made in your will or trust. It is an easy way to support our cause today and make a lasting future impact.

Benefits of a gift and bequest

- Receive a charitable income tax deduction for your gift made to us this year

- Continue to use and control your assets during your lifetime

- Leave a lasting legacy through a bequest to support our work after you are gone

How a gift and bequest works

You can make a gift to support our work this year by contacting us or visiting our website. A charitable bequest is a way to make your giving go further. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to Murray Education Foundation as part of your estate plan, or you can make a bequest by designating us as a beneficiary of your retirement account or life insurance policy.

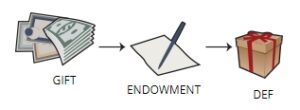

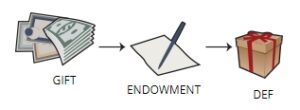

Endowment Gifts

An endowment is a fund you can create now or in the future to achieve the impact you desire.

You enjoy several benefits with an endowment gift

- Establish an endowment during your lifetime and see the impact each year

- Benefit from an income tax deduction in the year you make your gift

- Avoid capital gains tax on an endowment gift of appreciated property

How an endowment gift works

How an endowment gift works

- You make an initial gift to fund an endowment

- The assets in your endowment are invested to earn income

- The income is distributed annually to achieve your desired impact

- You can make additions during your lifetime or supplement your endowment with your estate plan

Income distributed from your endowment

At the time you create your endowment, you sign an endowment agreement that details the scope and desired impact of your endowment funds. Your funds will generally be invested to produce stable, predictable growth. Each year, a set percentage of your endowed funds will be distributed according to your endowment agreement.

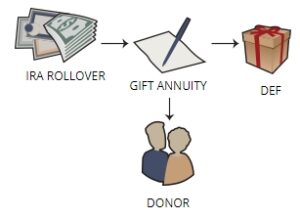

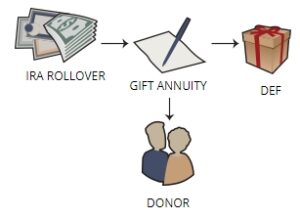

IRA to Gift Annuity Rollover

You may be looking for a way to help further our mission and enhance your income. If you are 70½ or older, you can make a one-time IRA rollover to fund a charitable gift annuity and receive fixed payments for life.

- Reduce your taxes with a one-time transfer of up to $53,000 from your IRA to a Gift Annuity

- Receive lifetime fixed payments for you and, if you choose, for your spouse

- Potentially reduce your required minimum distribution (RMD) this year

- Help further the work and mission of Murray Education Foundation

How an IRA rollover to gift annuity works

How an IRA rollover to gift annuity works

- Contact us about creating an IRA rollover to gift annuity with Murray Education Foundation.

- Contact your IRA plan administrator to make a one-time qualified charitable distribution (QCD) of up to $53,000 from your IRA to Murray Education Foundation.

- We will use your IRA gift to fund your gift annuity payments.

- Please note that IRA gifts do not qualify for a charitable deduction.

- After you receive payments for life, there will be a future gift to us.

- Please contact us if you wish your future gift to be used for a specific purpose.

Once you have determined one or more great ways to give, go here to learn about meaningful programs, projects, and services you can give to.